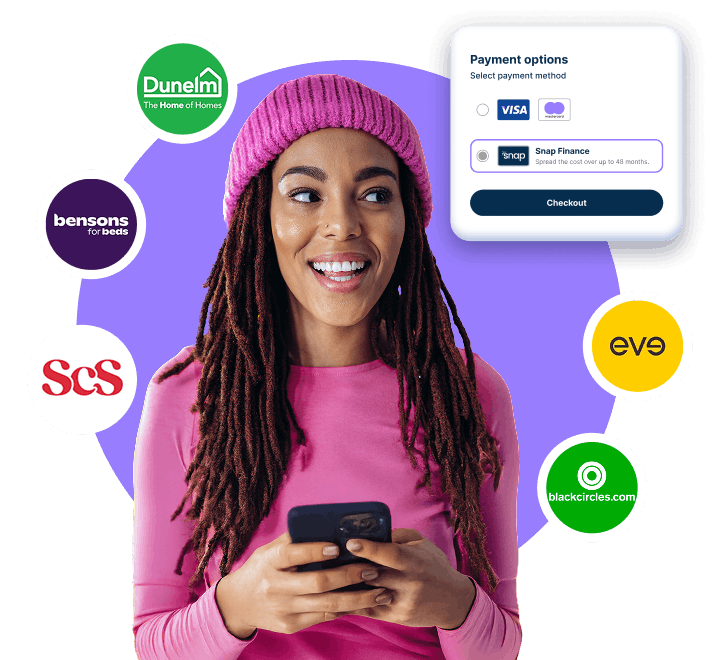

Flexible loans for your dream purchases

Borrow from £250 to £3,000 to shop online or in-store, with the flexibility to spread payments for up to 4 years.

Representative Example

Representative Example: Cost of Goods £1200, Deposit £0, Amount of Credit £1200, Annual Fixed Interest Rate 26.47%, Monthly Payment £65.28, Term 24 months, Total Payable £1566.72, Representative 29.9% APR

4 Steps to Snap!

We make financing fast, flexible and affordable.

Apply online

Apply now by clicking ‘Check Eligibility’. The process is simple and will not impact your credit score.*

Get your card

You can get a decision in minutes. Once approved, your card will be loaded with your budget in the Snap Wallet app.

Start spending

Spend over the next 30 days up to your budget, in-store or online. You can spend at multiple retailers of your choice.

Repay loan

These purchases will combine into one loan. You’ll pay for the amount you spend, on a monthly term that suits you.

*A full credit check will be carried out upon taking the loan which may affect your credit rating.

Why Choose Snap Finance

Seamless Purchasing Process

Our direct payment system to retailers removes complexities, enabling an immediate and smooth shopping experience.

Quick Decision Making

Our swift approval process reduces wait times, allowing you to move forward with your purchasing plans without delay.

Credit Building Opportunity

Making regular, timely repayments with Snap Finance could positively influence your credit score, enhancing your financial profile over time.

Dedicated Customer Support

Our customer support team is always ready to assist, offering guidance and answers throughout your finance journey, ensuring you have a seamless experience.

Your Snap Loan questions, answered!

How do I use my virtual card?

Once approved, you’ll receive a virtual card which you can access by downloading the Snap Wallet app. You can use it online or in stores by entering the 16-digit card number, expiry date, and security code.

How do repayments work?

After 30 days, whatever you’ve spent on your card becomes your loan which you repay on a monthly term that suits you. Your first payment is due on the selected day of the month, a minimum of 7 days after the spend window closes.

Is Pay in 4 included?

Yes, Pay in 4 is included. This feature of the loan allows you to settle in full within 4 months and Snap will cancel the interest. Opt in is required. For more information about Pay in 4, click here.

How does loan term impact approval amount and APR?

The APR you receive may change based on the loan term you select. The loan approval amount may also vary. Different term lengths can impact your rate and available budget. Make sure to choose the best option for you.

Have more questions?

Visit our FAQs page for more frequently asked questions.

Blogs

How to Improve Your Chances of Getting Retail Financing

27 February 2025

Retail financing can help spread the cost of purchases over time, but successful approval requires careful preparation.

How Payment Plans Can Help You Stay in Control of Your Budget

27 February 2025

Payment plans let you spread costs while staying in control of your money.

Retail Financing Explained: How It Helps You Manage Purchases

27 February 2025

Retail financing services provide consumers with flexible payment options, allowing them to spread the cost of purchases over time.

Don't take our word for it...

Here's what our happy customers like best about Snap Loan:

Keith Forbes

27 September 2025

Snap finance are helpful and listen to you if not sure about application form thank you snap

Alison Brooke

4 September 2025

Had an issue with the date of my payments Lola sorted it efficiently and quickly.x

Louise Anderson

6 August 2025

Spoke to Lola who was very helpful and sorted out my issue very quickly. Great customer service :)

Brian Sharpes

3 August 2025

I’m impressed by the company

gary stephen livsey

1 August 2025

Yvette was very polite and knowledgeable on the phone. she explained to myself, all the different ways forward, to pay off my finance arrears. She also maded sure this was an agreement that I could afford to do, to pay off all my arrears. Thanks Yvette.